On June 24th, we joined the UiPath event in London – a full-day experience dedicated to exploring what happens when agents, robots, and people operate together inside orchestrated enterprises.

This wasn’t just a conversation about AI trends. It was a hands-on look at how agentic automation is already delivering value across industries like banking, healthcare, retail, and construction – through live demos, customer stories, product launches, and strategic conversations.

The agenda was packed with strategic insights, product demos, and customer stories. From Graham Sheldon’s vision of an orchestrated enterprise, to hands-on sessions about how companies like Barclays, Travis Perkins, NatWest, The Body Shop, and Travelodge are applying agentic automation to deliver real business outcomes.

The day brought together voices from UiPath’s leadership, strategic partners, and enterprise clients, each contributing to a clear message: agentic automation is here, and it’s working.

From platform-level vision to real-world implementations, the sessions covered both the why and the how of this new automation era.

Below, we’ve started to summarise some of the most insightful discussions – and we’ll continue to update this post with more highlights as we go.

The Strategic Foundation of the Agentic Enterprise

Graham Sheldon – Chief Product Officer, UiPath

Graham Sheldon, Chief Product Officer at UiPath, opened the main stage with a clear message: agentic automation is where AI meets real ROI. He highlighted the gap between the excitement around generative AI and the actual business outcomes it has delivered so far.

According to recent studies (Gartner, McKinsey), over 92% of enterprises have initiated GenAI projects, but only a small fraction are seeing real value. The missing link? Integration and orchestration.

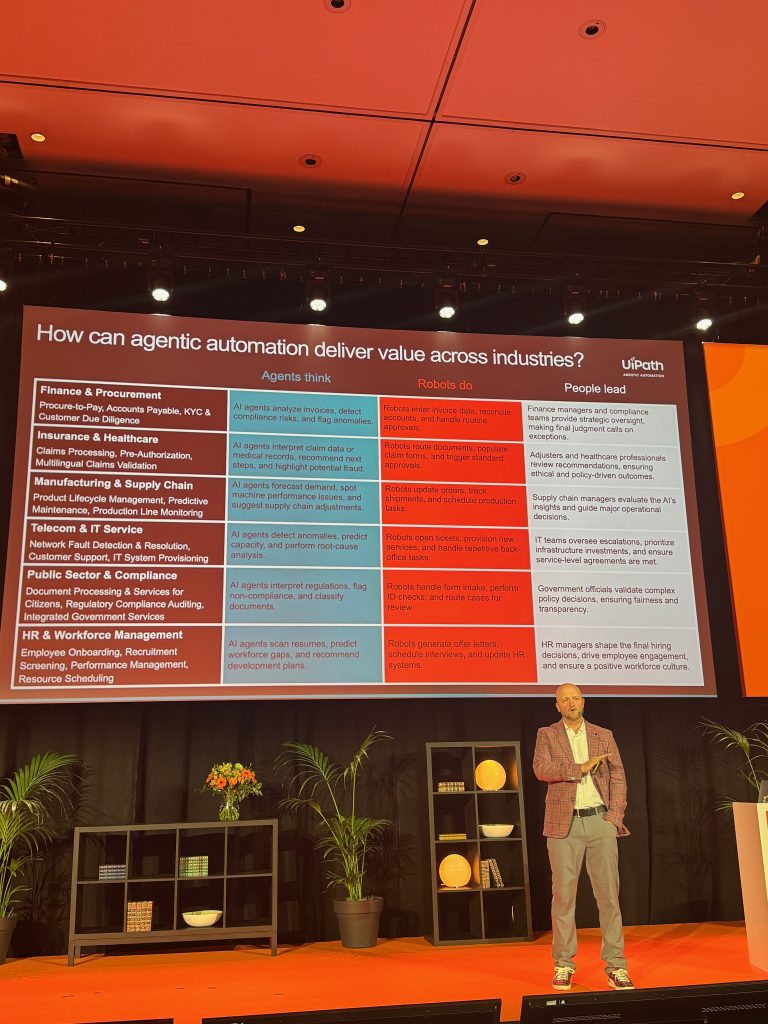

Sheldon explained that agentic automation is about combining deterministic automation (robots) with generative intelligence (AI agents), all orchestrated by humans. The key to unlocking business transformation lies in:

Targeting critical business processes, not just personal productivity

Co-creating solutions by pairing developers with business users

Building trust in AI systems with governance, visibility, and human oversight

A standout case was shared from Fiserv, a global fintech. By automating the classification and validation of merchant category codes:

They saved over 12,000 hours

Achieved 98% straight-through processing

Kept humans in the loop for edge cases, maintaining quality and accountability

Sheldon’s final message was clear: agentic automation isn’t a point solution – it’s a continuous transformation. And UiPath’s platform is now fully reimagined to support this shift.

Live Demo: Automating Loan Origination with Agents, Robots, and People

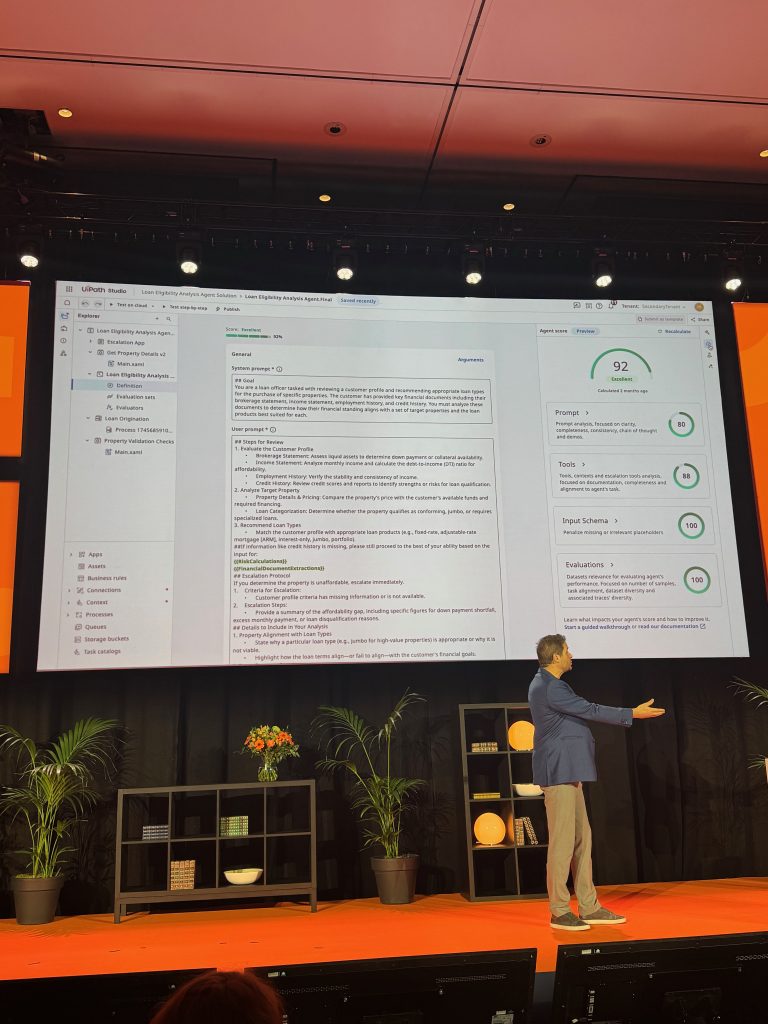

In one of the most practical sessions of the day, a UiPath product leader demonstrated how a complex loan origination process can be automated using the UiPath platform – bringing together IXP, Maestro, Agent Builder, and Action Center.

The scenario involved four key steps:

Document processing using IXP to extract structured and unstructured data from items like ID cards, bank statements, and brokerage reports

Eligibility analysis conducted by AI agents, some built using LangChain and third-party models

System updates and transactional work handled by robots

Human review via Action Center for low-confidence or complex cases

The demo also showcased:

Maestro, providing full visibility into each step, agent action, and prompt used

Agent Builder, which scores agents on clarity, alignment, and completeness (one example achieved 92%)

Real-time evaluation logs tracking agent performance across hundreds of applications

The result? A loan application process that used to take days could now be completed in minutes, with traceability, accuracy, and compliance built in.

The demo perfectly illustrated UiPath’s motto for this new era: Agents think. Robots do. People lead.

Why AI Isn’t Delivering Value Yet – And How Agentic Automation Fixes That

In a compelling talk, Edward Challis, Head of AI Strategy at UiPath, explored a pressing question:

If AI has evolved so dramatically, why hasn’t it translated into real economic impact for most companies?

A Technology Growing Faster Than We Realize

Challis began by reviewing the exponential progress of AI over the last 60 years. While AI models used to grow steadily at around 40% annually (in line with Moore’s Law), the past 15 years have seen a dramatic shift – with model size and complexity growing by 400% each year.

Today’s frontier models surpass 2 trillion parameters, outperforming humans on graduate-level exams in math, logic, and coding. A key breakthrough has been AI’s ability to generate its own training data through reasoning and self-correction, enabling models to continue scaling despite past limitations.

The Economic Paradox

Despite this technical leap, the economic results haven’t followed. According to Challis:

Over 90% of enterprises have deployed AI tools

Yet more than 80% report no measurable impact on revenue, margins, or productivity

This disconnect, he argues, is due to:

Shallow usage – most applications are not deeply integrated into specific workflows

Lack of orchestration – AI remains isolated from enterprise systems, tools, and human decision-making

What Is an AI Agent?

To address this gap, Challis outlined what defines an AI agent:

A large language model capable of reasoning and decision-making

Access to tools that allow it to retrieve data, interact with systems, and take actions

A goal or objective that drives its behavior within a looped, autonomous execution framework

Without tools or orchestration, an AI agent is “just a next-word predictor,” he noted.

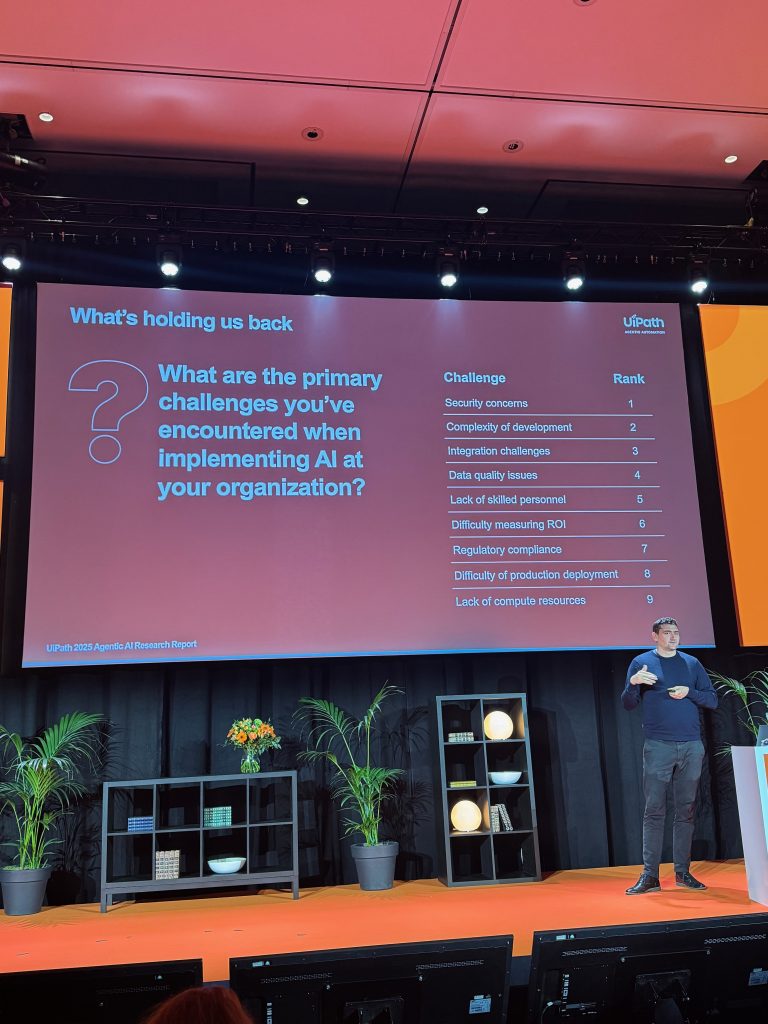

What’s Holding Enterprises Back?

UiPath surveyed over 250 executives to understand implementation challenges. The main blockers were:

Security and governance – especially in terms of traceability and control

Development complexity – building agents often requires rare AI engineering expertise

Integration – most enterprise data is messy and lives in silos

Lack of scalability – too few people in the business can actually build and deploy agents

Reliability – what works in a demo may not work the same in production

These pain points were echoed in third-party analyst reports, which consistently pointed to the need for better autonomy, integration, orchestration, and testing.

The Next Era: Autonomous Agents That Work with People

Challis concluded by drawing a line between yesterday’s conversational agents and today’s autonomous agents. Unlike chatbots that wait for prompts, these new agents can:

Be triggered by business events

Access tools and systems independently

Advance tasks or escalate to human review as needed

Ultimately, the vision is of hybrid teams of agents, people, and systems working together with speed, agility, and consistency. The missing link, he stressed, is orchestration – and that’s where UiPath is focused.

Barclays: From RPA to Agentic Automation – A Scalable, People-First Approach

In a fireside chat moderated by UiPath’s Carol Bolton, Sundar Ganesh, Global Head of Process Automation at Barclays, shared the bank’s transformation journey – from early automation to preparing for an agentic future.

Having travelled from India to speak at the event, Ganesh gave an open and detailed account of how one of the world’s largest banks has approached automation strategically, incrementally, and with people at the center.

A Structured Start: PACE and the Foundation for Scale

Barclays began building its automation capability in a structured way around 2019, forming a dedicated center of excellence called PACE (Process Automation COE). This unit delivers automation as a service across all divisions of the bank, with end-to-end delivery responsibility – from demand intake and prioritization to execution and support.

Key priorities from the start included:

Accelerating delivery while maintaining strong control

Leveraging a full suite of technologies – from RPA to machine learning and process mining

Focusing on customer experience and employee empowerment, not just cost savings

At its peak, the program ran over 30 concurrent automation initiatives, with each case evaluated individually for impact – typically aiming for a minimum 30% benefit, whether in effort reduction or customer satisfaction.

Why Barclays Chose to Deepen Its Partnership with UiPath

Barclays initially used another RPA vendor but shifted fully to UiPath about a year ago. According to Ganesh, the decision was driven by:

Alignment of vision and product roadmap

Innovation capabilities (including the latest agentic tools)

A strong, trust-based relationship with UiPath’s team

Still, he emphasized that Barclays remains platform-agnostic, using multiple technologies – but UiPath now plays a key role in delivering unified, scalable solutions.

Cloud and Control: A Thoughtful Transition

Ganesh also addressed the shift to cloud, noting that UK financial services were initially hesitant, but Barclays is now fully cloud-first. Key to success was:

Cross-functional engagement with stakeholders from tech, security, and operations

Clear plans for data governance and platform architecture

A focus on managing automation, not infrastructure

This shift enables faster innovation and simplifies deployment across the bank.

Preparing for the Agentic Era

When asked how Barclays is getting ready for agentic automation, Ganesh emphasized:

Thinking beyond tasks to full end-to-end journeys (e.g., the mortgage process)

Ensuring alignment with the bank’s broader AI governance strategy

Running workshops with UiPath and business teams to explore what’s possible

Building internal capabilities and infrastructure gradually, case by case

One creative approach: “process parties” – three-day collaborative sessions where operations, engineering, and governance teams solve a real business problem and move it into production. Not a hackathon, but a focused delivery sprint that accelerates results and creates momentum across the organisation.

What Made the Difference

Ganesh closed with three key learnings:

Build a strong foundation – with structure, clarity, and scalability

Secure executive sponsorship and cross-bank collaboration

Bring people along – from engineers to governance teams – through shared ownership and practical results

Barclays’ journey shows that agentic automation isn’t just about new tech. It’s about connecting people, processes, and systems –intelligently, securely, and with purpose.

From Pebbles to Boulders: What the Founder of Shazam Taught Us About Breakthrough Thinking

Chris Barton didn’t just build an app. He built an idea that defied the status quo and turned it into a global habit. His story isn’t about luck or a moment of genius. It’s about breaking assumptions, creative persistence, and removing friction until there’s nothing left but the essential.

Here are the key takeaways from his talk:

1. Build from basic truths, not assumptions

Innovation doesn’t start with what already exists. It starts by stripping everything down to raw facts. For Barton, those truths were simple: every phone has a microphone, and music is sound. He built Shazam not by improving existing tech, but by imagining a world where you could identify a song just by hearing it, anywhere, anytime.

2. Creative persistence is more than not giving up

Entrepreneurs are praised for persistence. But Barton argues it’s not just about pushing through – it’s about doing so creatively. When Shazam couldn’t get access to a digital music database, they built their own from physical CDs. When no venture capital wanted to invest, they pitched 100+ firms until they found three that believed. When the core algorithm seemed impossible, they found the one expert who could solve it – and made someone else choose him.

3. The biggest barriers often look like small pebbles

One of his strongest points: we often ignore friction because it looks small – just “one click” or “one extra form.” But that one click can kill a product. Dropbox became huge not because it worked, but because it worked with zero clicks. Shazam didn’t grow until it became frictionless – when it moved from a paid SMS service to a free iPhone app.

4. Real innovation means defying your own brain

Our brains are wired to work by analogy, to take shortcuts and rely on what’s worked before. Barton calls this out: truly new ideas come when we force ourselves to question even the obvious. That’s uncomfortable. It’s also necessary.

5. Emotion drives impact

The most powerful moment in his journey wasn’t raising millions or selling to Apple. It was hearing two strangers in a store say, “Let’s Shazam it.” When people use your product like a verb, you’ve built more than software – you’ve built culture. And that only happens when you’re deeply, emotionally invested in what you create.

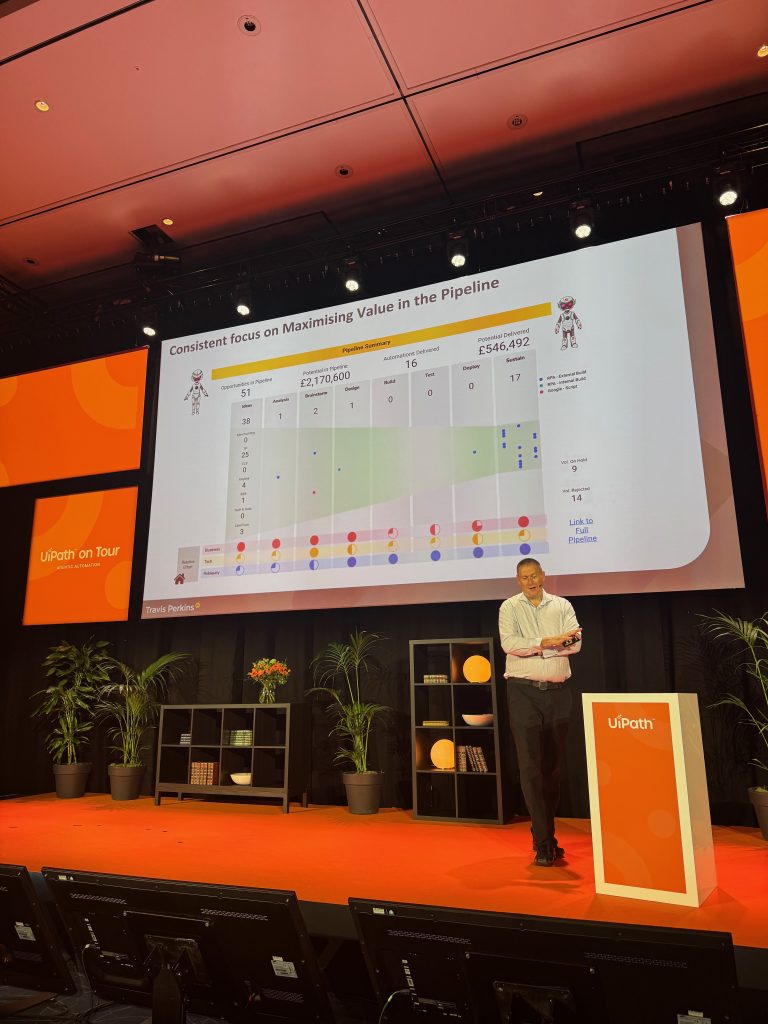

From Paper to Progress – Building Automation in a 200-Year-Old Industry

Matt Webb, Head of Business Process Improvement at Travis Perkins, delivered a refreshingly honest and practical talk on what it really looks like to bring automation into a company with 200 years of history, 17,000 employees, and a warehouse full of bricks… and paper.

Not Your Classic Automation Poster Story

“We’re not the poster child for automation,” Matt admits early. It’s been a slow burn – a journey marked not by instant transformation but by persistent problem-solving in a deeply fragmented environment.

Travis Perkins is the UK’s largest distributor of building materials, with hundreds of branches and dozens of specialist sub-brands. The challenges? Legacy systems, decentralised operations, massive process variation, and a culture used to doing things “the old way.”

Where They Started

The first business case was shot down by the CIO. Then COVID hit. Then leadership changed. And then the opportunity came back – this time with a small fund to prove if automation could even work in their context.

Matt and team approached it like building a house:

Start with solid foundations: automation infrastructure and culture

Build walls and a roof: simple bots automating tasks people were already doing

Then, start reimagining: processes, journeys, and customer experiences redesigned with automation in mind

How They Made It Work

To prove automation could stick, they:

Focused ruthlessly on ROI (aiming to justify each automation in under 12 months)

Proved it worked with legacy mainframes, third-party web apps, and Google Workspace

Measured brutally: some automations didn’t deliver – they were shut down fast

What They Delivered

Accounts automation in credit services – saving time and improving risk assessment

AI-powered credit limit reviews – summarising data from complex docs

ERP survival automations – fast fixes when the ERP rollout hit turbulence

Query management using comms mining – addressing invoice-related queries in near real time

Real-time decisioning – starting cautiously, building confidence, then moving toward agentic automation

Lessons That Stick

Don’t just build faster versions of old problems

Challenge business teams to think beyond speed. Think differently.Say no more often

Not every idea is worth automating – especially if it distracts from high-impact opportunities.Focus on the problem, not the tech

Conversations that start with “we’ve got RPA” go nowhere. Conversations that start with “what’s the real blocker here?” unlock real potential.Automation works best when it’s owned by the business

When teams see bots as part of their team, adoption soars. When it’s “just IT’s thing,” it fails.

NatWest: How Smarter Testing Became a Driver of Innovation, Not Just a Cost Center

In a lively pre-lunch conversation, Chris Booth, Engineering Lead at NatWest, joined Richard Spence from UiPath to discuss how testing – once seen as a necessary bottleneck – is being reimagined as a strategic enabler of agility, innovation, and risk management.

From Banking to Software Delivery at Scale

Booth started by framing the transformation underway at NatWest: with over 90% of customer interactions now digital, the bank increasingly operates like a technology company with a banking license.

NatWest has around 10,000 engineers across the UK and India

Every business outcome now depends on fast, reliable, and secure software delivery

Testing, once a back-office function, has become a core capability in how the bank serves customers and manages risk

Why Testing Had to Change

Traditional testing approaches couldn’t keep pace with the demands of modern banking. The bank set bold targets:

Everything should be deployable within one hour

All testing must be automated

While these are stretch goals, they have created clarity and urgency. The need to compete with digital-native banks (like Starling or Monzo) made it essential to rethink how testing is done – from waterfall to real-time, intelligent automation.

The Impact of Agentic Testing

Since adopting UiPath’s agentic testing suite, NatWest has seen measurable results:

A 40% reduction in the number of manual testers in the past two years

Faster release cycles, without compromising quality or compliance

The ability to automate audit trails and produce test evidence on demand

Booth explained how testing is now tightly integrated into development. Teams operate in feature-based squads aligned to customer journeys, with testing automated and running continuously. This setup allows faster experimentation, better releases, and even external recognition—like awards for their mobile app experience.

Managing Risk More Intelligently

Agentic testing has also shifted how NatWest manages risk. Instead of relying on documentation and manual approvals, the bank now uses:

Automated, repeatable testing pipelines

Clear thresholds (e.g., “90% of tests must pass”)

Real-time visibility into performance and code stability

This approach enables principle-based risk governance, where regulatory confidence is built into the delivery process – not added after the fact.

Lessons on Change and Adoption

Booth emphasized that success required both top-down vision and bottom-up engineering buy-in:

Engineers naturally adopt new tools – but scale requires leadership mandates

Publishing performance metrics (like deployment times) drives alignment and behavior

Clear goals, like “deploy in under an hour,” help unify efforts across teams

His advice for others?

Set a North Star metric everyone can align to

Accept that change requires time and investment

Start small – but start now

Testing, he concluded, is no longer a cost to be minimized. It’s a strategic lever for speed, quality, and continuous delivery in a competitive market.

Strategic Perspective: “GenAI is Everywhere (Except in the P&L)”

Brendan Gaffey, Senior Partner and Global Head of McKinsey’s TMT Practice, delivered a sharp and grounded reality check on the current state of AI in the enterprise. His talk opened with a clever reference to Marc Andreessen’s famous “Software is eating the world” article – drawing a parallel to how agentic AI is now poised to reshape not just productivity, but business models themselves.

Despite the explosive adoption of GenAI – with 80% of enterprises using it in at least one domain – most companies still report no material impact on their bottom line. Brendan unpacked this paradox with clarity: fragmented initiatives, poor data quality, lack of workflow integration, and immature tooling are stalling real transformation.

He emphasized that true value doesn’t come from isolated copilots or simple task automation, but from end-to-end journey orchestration – where agentic automation can operate across silos, proactively take action, and continuously improve through real-time feedback loops. He contrasted shallow GenAI applications with deeply integrated agents that have autonomy, access to enterprise tools, and alignment with business outcomes.

One of his most compelling points was about the “fat tail” of enterprise processes – those bespoke, complex workflows that SaaS systems have historically struggled to handle. This is where agentic automation thrives. Instead of retrofitting automation to legacy processes, companies should radically redesign them from the ground up, using agents as core building blocks.

He closed with five key enablers for enterprise success in this new era:

a new HR model for hybrid workforces,

dual support for low-code and pro-code agents,

robust governance frameworks,

enterprise-grade data readiness, and

willingness to rethink workflows entirely.

Agentic automation, in McKinsey’s view, isn’t just another tech upgrade – it’s a strategic shift that will differentiate the winners in the next business cycle.

Daniel Dines & Brendan Gaffey – Fireside Chat: From AI Hype to Operational Reality

The conversation between Daniel Dines and Brendan Gaffey built naturally on the day’s core theme: how to move beyond the hype and make agentic AI deliver real enterprise value.

Brendan reinforced a striking insight from his earlier keynote: while 80% of companies report experimenting with GenAI, few are seeing meaningful impact on the bottom line. The reason? Fragmented pilots, lack of orchestration, and AI being kept in separate silos from the core of the business.

Daniel agreed – highlighting that the level of interest around agentic AI today is even higher than during the early days of RPA. But most companies are still experimenting with small use cases, often mislabeled as agents when in fact they are just LLMs wrapped around micro-tasks, initiated by humans. What’s missing, he argued, is trust, governance, and the ability to scale.

They both stressed that traditional automation and agentic AI are complementary. Bots bring precision and cost efficiency; agents bring adaptability and reasoning – but are expensive and harder to control. The future lies in combining both with strong orchestration.

One of the key themes that emerged was risk: while errors in RPA may be manageable, a wrong decision by an agent can be extremely costly. That’s why human-in-the-loop validation, auditing, and gradual trust-building are essential.

They also pointed to organizational challenges. In most enterprises, automation and AI still sit in separate COEs – RPA often inside the business units, while AI is managed by back-office tech teams. That needs to change. AI must become part of core business operations, not just a support layer.

On workforce impact, Daniel acknowledged that the pace of change may outstrip our ability to adapt. Companies need to invest in upskilling, but also be honest: the transition will be bumpy, and not every job can be saved. Brendan added that C-level leaders must guide this change with clarity – not just about which jobs might be lost, but where new value will come from.

They closed with a clear message: agents alone are not the solution. Only when agents are orchestrated with people, robots, and processes can they deliver real enterprise outcomes. UiPath’s role, they emphasized, is not to build standalone agents – but to build the layer that connects everything together with trust, governance, and measurable impact.

Human First: Transforming Healthcare with Automation and AI

Speakers: Matt Hogarth (UiPath), Mark Crannage (Cambridgeshire Community Services NHS Trust), Jonathan Gregory (Pivotal Health)

The healthcare panel brought a grounded, human-centric perspective on automation – reminding everyone that transformation isn’t just about systems, but about people.

Mark Crannage shared how his trust chose to automate the paediatric referrals process – a decision driven not by finance or HR efficiency (as is often the case), but by the real-world impact delays had on children’s care. Prior to automation, processing a single referral took around 40 minutes. With the introduction of their digital worker “Ada” (named in honor of Ada Lovelace), that time dropped to under five minutes, saving 116 hours per month. But the bigger win? Staff were freed up to focus on human interaction and frontline needs. Ada is now seen as part of the team – complete with an appraisal process and dashboards to monitor performance.

Jonathan Gregory addressed another overlooked challenge: treatment summary letters for cancer patients. Despite being vital, only 15% of patients in the UK receive one. The reason? Time constraints. By using routinely collected data and simple automation logic, his team built a prototype that generates these letters automatically – delivering better continuity of care, especially for patients impacted by health inequalities. For many, receiving clear guidance post-treatment can prevent confusion, reduce unnecessary A&E visits, and improve health outcomes. The pilot already led one skeptical consultant to shift from 50% to 100% adoption after seeing the impact firsthand.

The panel also introduced “Chuck” and “Alan,” additional digital workers helping across dental referrals and correspondence across multiple EPR systems. Together, they’re projected to save nearly 300 hours/month – again, not to reduce headcount, but to reallocate human time to patient care and backlog reduction.

Looking ahead, Mark hinted at an ambitious new pilot combining traditional automation with agentic AI. The goal? A hybrid flow where agents lead digital workers across triage and screening in community services – a full, orchestrated pathway powered by both bots and agents.

The session ended with a reminder: in healthcare, automation is ultimately about freeing up humans to be more human. And that starts by designing systems with empathy, not just efficiency.

The Body Shop & Peak – Elevating Retail Decision-Making with AI

This session, featuring Hilary McNair from The Body Shop and Richard Potter, co-founder and CEO of Peak (now part of UiPath), explored how commercial decision intelligence – powered by AI – can drive faster, smarter, and more consistent business outcomes across global retail operations.

The Body Shop operates in nearly 80 markets, with a mix of company-owned and franchise models – making pricing and product strategy highly complex. Historically, these decisions relied heavily on Excel, manual judgment, and limited visibility across markets.

The tipping point came when support for franchisees became increasingly difficult to scale. Opening new markets meant having to deprioritize value-added activities due to bandwidth constraints. That’s when Hilary met Peak’s team at a retail conference – initially without knowing AI would be part of the solution.

They began by focusing on pricing, an area where inconsistencies and missed opportunities were hurting performance. With Peak, The Body Shop moved from fragmented spreadsheets to AI-driven pricing insights, identifying opportunities to raise prices for high-performing ranges (like their Tea Tree skincare line), and reduce prices where products were over-reliant on promotions. Early results showed strong positive commercial impact.

Another big win came in product assortment optimization. The team planned to discontinue 30 SKUs based on surface-level metrics. But Peak’s AI helped reveal the hidden value of those products in cross-market performance and basket-building, avoiding unnecessary discontinuations and revenue loss.

On promotions, AI uncovered campaigns that underperformed or added noise to the customer journey. They simplified the promo calendar based on data-driven guidelines – improving store clarity and overall effectiveness.

The biggest shift, though, was in decision confidence and speed. The insights didn’t just guide better decisions – they accelerated them. Conversations that would typically drag out over weeks were concluded in a matter of hours because the data was so clear.

Internally, working with AI tools boosted team engagement and became a strong talent attraction point. Externally, franchisees were impressed by the clarity and objectivity brought by the data. Some even expressed interest in using the tools themselves.

Hilary’s advice to others starting on an AI journey?

Be clear on your challenges, but stay open to new solutions

Choose a partner who really understands your business context (especially if you operate in a franchise model)

Be prepared to challenge your own assumptions

The message was clear: AI, when applied to decision-making – not just automation – can create massive value. But only if you start with real business needs, ask the right questions, and build trust through collaboration.

Human-Driven Transformation with Agentic Automation

Heather Barton-Jones – Strategic Transformation Office, UiPath

Heather Barton-Jones closed the day with a powerful, human-centered keynote that challenged the audience to look beyond technology and toward the real drivers of transformation: people.

1. The Uncomfortable Truth

Change is hard. And delaying change comes at a cost:

Competitors accelerate while we hesitate.

Talent leaves for more innovative cultures.

Customers notice when we fall behind.

Heather urged leaders to move from consensus to conviction, asking one simple but powerful question:

“What do we risk by not moving forward with this?”

2. A Real Transformation Story

She shared the story of a Swedish enterprise that set a bold 10% operating margin goal.

Instead of starting with a proof of concept, they asked UiPath to embed deeply into their operations and co-design a transformation strategy centered on business outcomes.

The outcome? UiPath now sits at the heart of their operating model, guiding decisions at C-suite level – every hire, every process, every redesign.

3. People First, Tech Second

Heather reminded the audience that technology alone does not create transformation – people do.

Employees already know:

Where inefficiencies lie

Which processes slow them down

What truly matters in their daily work

“Ask them. Involve them. Empower them to shape their future role in collaboration with agents.”

4. From Fear to Empowerment

AI and automation are often met with fear – but not fear of job loss, rather fear of losing relevance.

The solution? Upskilling, education, and visibility.

Heather emphasized the need for:

AI literacy and human-in-the-loop understanding

Empowering teams to work alongside digital agents

Highlighting how automation enhances their value, not replaces it

5. Leadership: It Starts With You

True transformation requires:

Clear, measurable ambition

Cross-functional champions

Top-down sponsorship

Daily unblocking of barriers by leadership

“This isn’t someone else’s responsibility. It’s yours.”

Heather left the audience with a simple challenge:

“Are you innovating for tomorrow or preserving yesterday?”

And one final prompt:

“What is one process you will transform? What blocker will you remove for your team? And whose spark will you ignite by doing so?”

A powerful close to an energizing and forward-thinking event.

Final Thoughts

The UiPath London event made one thing clear: the agentic era is no longer a vision – it’s here, and it’s changing how work gets done. From deep AI strategy and exponential model growth to real enterprise outcomes shared by companies like Barclays, NatWest, and Travis Perkins, the message was unified: businesses must move beyond experimentation and start building orchestration, trust, and human-centered design into every layer of transformation.

Whether through autonomous agents, copilots, or orchestrated workflows, those who act now will shape the future. Those who hesitate risk falling behind – not just in tech, but in talent, agility, and relevance.